Which Generation Had it Toughest?

By: Mark McCrindle

For decades, intergenerational discourse has been dominated by narratives of hardship and advantage.

Each generation believes they faced unique economic challenges that others simply don’t understand. But what does the data actually tell us about who had it toughest?

A Financial Reality Check

The generational debate about who had it hardest economically is more complex than it first appears. Looking at data comparing the financial realities faced by Baby Boomers, Gen X, Gen Y, and Gen Z reveals surprising insights about affordability, opportunity, and economic challenges across the decades.

It is clear from this analysis that each generation has had to navigate a unique set of economic and social realities. From the post-war boom to the digital age, the financial landscape for young Australians has transformed dramatically. But has it become progressively harder to build a life? A look at key financial indicators for four generations at a similar life stage aged in their late teens to early thirties paints a compelling picture of shifting challenges and opportunities.

The foundations: Earnings and the Economy

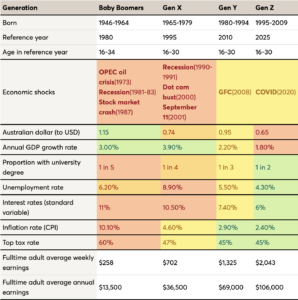

To understand the financial world of each generation, we can look at their circumstances in a reference year when they were in a similar age bracket.

Baby Boomers: At ages 16-34, Baby Boomers faced a high inflation rate of 10.1% and a top tax rate of 60%. Full-time average annual earnings at this time were $13,500.Gen X: Aged 16-30, Gen X entered a workforce with 8.9% unemployment. Average annual income sat at $36,500, but a high standard variable interest rate of 10.5% made borrowing expensive.

Gen Y: Also aged 16-30, Gen Y (or Millennials) saw lower inflation at 2.9% and interest rates at 7.4%. Average annual earnings at this time had increased to $69,000.

Gen Z: For today’s emerging adults, aged 16-30, the economic climate is one of relatively low unemployment (4.3%) and inflation (2.4%). The average annual income now sits at $106,000.

The Great Australian Dream

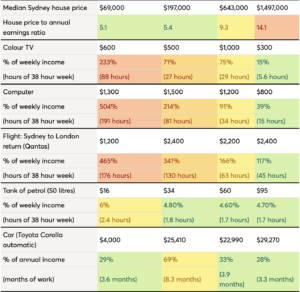

The most striking shift across the generations is the accessibility of housing. For a young Baby Boomer in 1980, the median Sydney house price was $69,000, which equated to 5.1 times their average annual earnings. Fast forward to 2025, and for Gen Z, that same dream carries a median price tag of nearly $1.5 million, a staggering 14.1 times their annual income.

While Gen X saw the house price-to-earnings ratio remain relatively stable at 5.4, it was Gen Y who experienced the significant leap, with the ratio jumping to 9.3. This demonstrates that while incomes have grown, the price of entry into the property market has grown exponentially faster, placing unprecedented pressure on younger generations.

The Cost of Living: From Cars to Colour TVs

The story of affordability becomes more nuanced when looking at consumer goods and lifestyle costs. Here, technological advancement and global manufacturing have worked in favour of younger generations.

Technology: A colour TV in 1980 would have set a Baby Boomer back 233% of their average weekly income, or the equivalent of 88 hours of work. For Gen Z, a far more advanced television costs just 15% of a week’s wage (5.6 hours). The affordability of computers tells a similar tale, dropping from 191 hours of work for a Boomer to just 15 hours for Gen Z.

Transport: The cost of a new Toyota Corolla has fluctuated. For a Baby Boomer, it represented about 3.6 months of their annual income. This peaked for Gen X at 8.3 months before settling back to 3.9 months for Gen Y and 3.3 months for Gen Z. Interestingly, the cost of a tank of petrol has remained remarkably consistent as a proportion of weekly income, requiring between 1.7 and 2.4 hours of work for all generations.

Travel: Global travel, once a significant luxury, has become more accessible. A return flight from Sydney to London for a Baby Boomer was equivalent to 176 hours of work. For Gen Z, that has fallen to just 45 hours.

The Intergenerational Challenge

Each generation’s economic experience must be understood within its broader context. Baby Boomers faced high inflation and interest rates but could access affordable housing. Gen X navigated economic uncertainty but still found reasonable property prices. Gen Y pioneered the digital economy while watching housing slip away. Gen Z inherits technological advantages but faces unprecedented housing costs.

The question of who had it toughest depends on what we value most. If homeownership and traditional wealth accumulation matter most, Baby Boomers and Gen X clearly had advantages. If technological access and economic stability are priorities, Gen Y and Gen Z have benefits their predecessors couldn’t imagine.

Rather than determining a winner in the “who had it toughest” debate, the data suggests each generation faced unique challenges that required different strategies for success. The economic game hasn’t become easier or harder, it has fundamentally changed.

Understanding these differences is crucial for policy makers, employers, and families navigating intergenerational relationships. Each generation’s economic reality shaped their values, expectations, and opportunities in ways that continue to influence Australian society today.

The true challenge isn’t determining who had it toughest, but understanding how these different economic realities created the intergenerational dynamics we see today.

Click here for the Generational Worker Profiles Infographic

So, Who Had it Toughest?

Every generation has faced its unique economic headwinds, from high inflation and interest rates for Baby Boomers to periods of high unemployment for Gen X. However, the data points to a clear and escalating challenge for younger generations in securing the foundational asset of a home.

While Gen Z and Gen Y enjoy unparalleled access to cheaper technology, consumer goods, and international travel, the barrier to entry for housing is higher than ever before. The sheer scale of the house price-to-income ratio for Gen Z suggests that despite higher earnings and a favourable economic environment in other areas, the goal of home ownership, a cornerstone of financial security for previous generations, is now a monumental challenge.

Ultimately, defining which generation had it toughest is complex. While older generations grappled with higher costs for everyday goods and steeper borrowing costs, the fundamental building block of wealth property was significantly more attainable. For Gen Y and particularly Gen Z, the Australian dream is being redefined in an era where the cost of a roof over one’s head has far outpaced the growth in their wallets.

Article supplied with thanks to McCrindle.

About the Author: McCrindle are a team of researchers and communications specialists who discover insights, and tell the story of Australians – what we do, and who we are.

Feature image: Canva